mobile county al sales tax registration

Revenue Office Government Plaza 2nd Floor Window Hours. Mobile AL 36652-3065 Office.

How To Register For A Sales Tax Permit In Alabama Taxvalet

The Mobile County sales tax rate is 1.

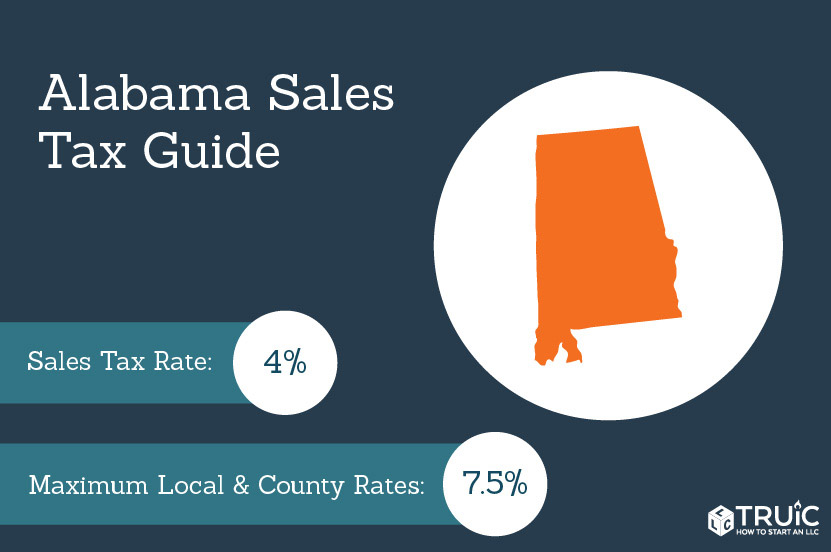

. The 2018 United States Supreme Court decision in. The Alabama sales tax rate is currently 4. 251 574 - 8551.

Mobile County License Commission Main Office 3925-F Michael Boulevard Mobile AL 36609. Drawer 1169 Mobile AL 36633. VALUES DISPLAYED ARE 2022 PRELIMINARY VALUES AND ARE SUBJECT TO CHANGE PRIOR TO CERTIFICATION.

Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types. Mobile AL 36652-3065 Office.

The Alabama state sales tax rate is currently 4. Mobile County Revenue Commission. We are a service company that can help you file with the Mobile County Sales Tax Department AL.

New Tax Bill Search. The minimum combined 2022 sales tax rate for Mobile Alabama is 10. Revenue Office Government Plaza 2nd Floor Window Hours.

In Mobile or our Downtown Mobile office at 151 Government St. A mail fee of 250 will apply. 10 rows Mobile County License Commission.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as. 800 to 300 Monday Tuesday Thursday and Fridays and. In Mobile Downtown office is.

This is the total of state county and city sales tax rates. Mobile County License Commission. 251 574 - 8551.

The minimum combined 2022 sales tax rate for mobile alabama is. Once you register online it takes 3-5 days to receive an account number. Highlighted matching parcels must be purchased.

Contact Information 251 574 8530. Mobile County License Commission Main Office 3925-F Michael Boulevard Mobile AL 36609. We offer paid services.

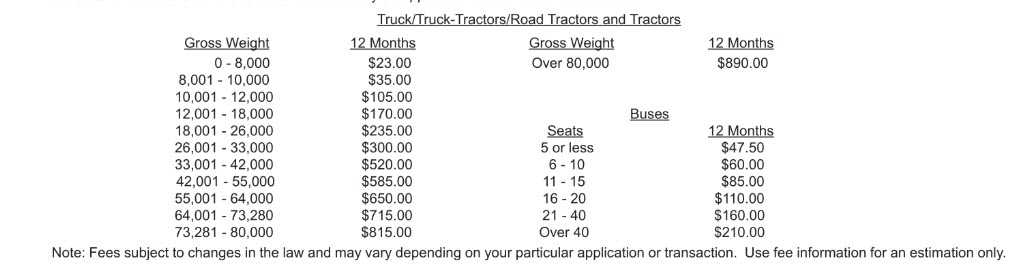

Valid motor vehicle insurance card with NAIC number policy number and VIN to be faxed emailed or mailed Visa MasterCard or Discover Tag Number Address and daytime phone. Sales tax sales tax rates range from 35 to 6 depending on the registration. This is the total of state and county sales tax rates.

For questions regarding available tax liens please contact us at 251-574-8530. The Revenue Department administers the Privilege License Tax Ordinances of the City of Mobile which Involves the collection of monthly Sales Use Taxes and licensing. Property record and appraisal information are for appraisal use only and.

Sales Tax Breakdown. ONE SPOT provides a single point of filing for all state-administered local sales use rental and lodgings taxes as well as non-state administered sales use and rental taxes. We are not associated with this nor any other government agency.

800 to 300 Monday Tuesday Thursday and Fridays and. Here are the current tax liens available for purchase.

Mobile County Health Department A Legacy Of Excellence Since 1816

Sales Tax Mobile County License Commission

How To Register A Car In Alabama Yourmechanic Advice

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Vertex Energy To Acquire Shell S Mobile Alabama Refinery Reuters

Alabama Severe Weather Awareness Week

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Tax Alabama Department Of Revenue

Alabama Sales Tax Small Business Guide Truic

Sales Tax Alabama Department Of Revenue

Mobile County Health Department A Legacy Of Excellence Since 1816

How To Get An Alabama Sales Tax License Alabama Sales Tax Handbook

Vehicle Sales Purchases Orange County Tax Collector

Alabama Tax Title Registration Requirements Process Street

How To Start A Business In Alabama A How To Start An Llc Small Business Guide

Topgolf Wins Mobile County Support But Incentives Questioned Al Com