student loan debt relief tax credit application

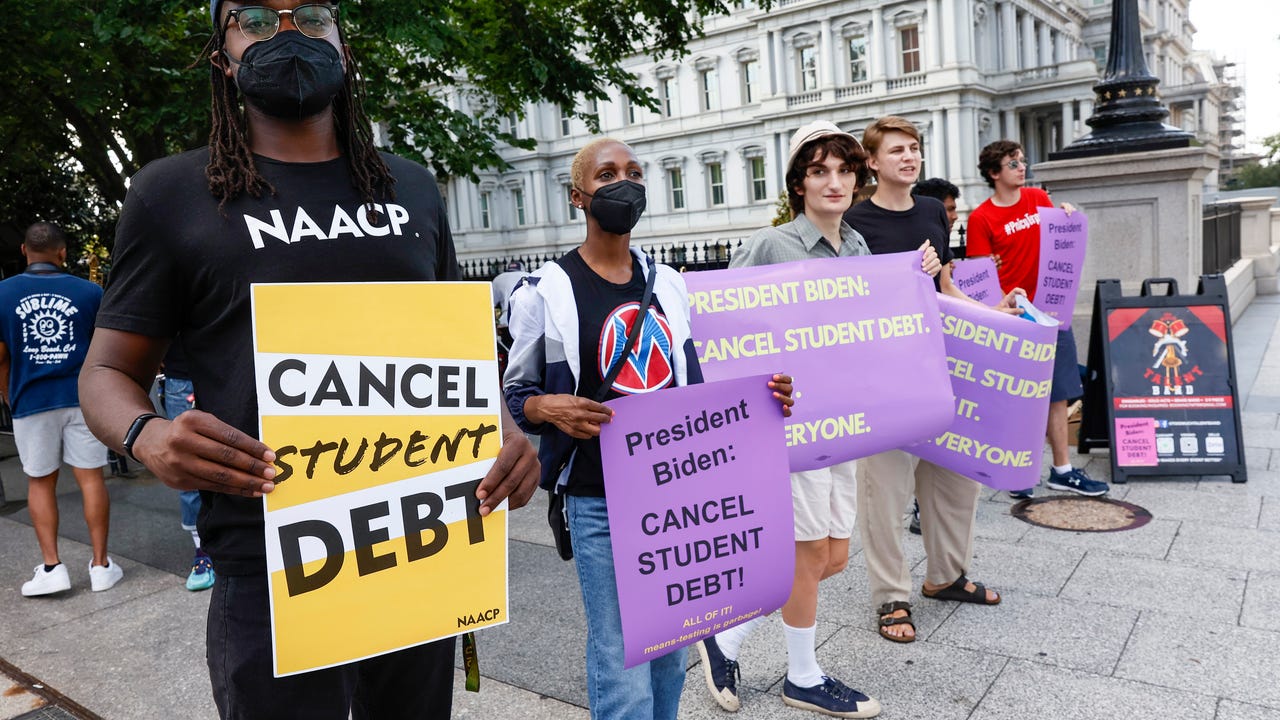

15 hours agoThe debt forgiveness plan announced in August would cancel 10000 in. SUPPORTING DOCUMENTATION FOR LENDERThe following documents must be included.

Prince George S County Memorial Library System Applications For The Maryland Student Loan Relief Tax Credit For 2021 Are Due Tonight At 11 59pm Et If You Meet The Criteria Apply Great Opportunity

I request federal student loan debt relief of up to 20000.

. 18 hours agoThe little-known student loan middlemen who are threatening debt forgiveness. You must have an outstanding student loan balance of at least 5000. This application and the related instructions are for Maryland residents who wish to.

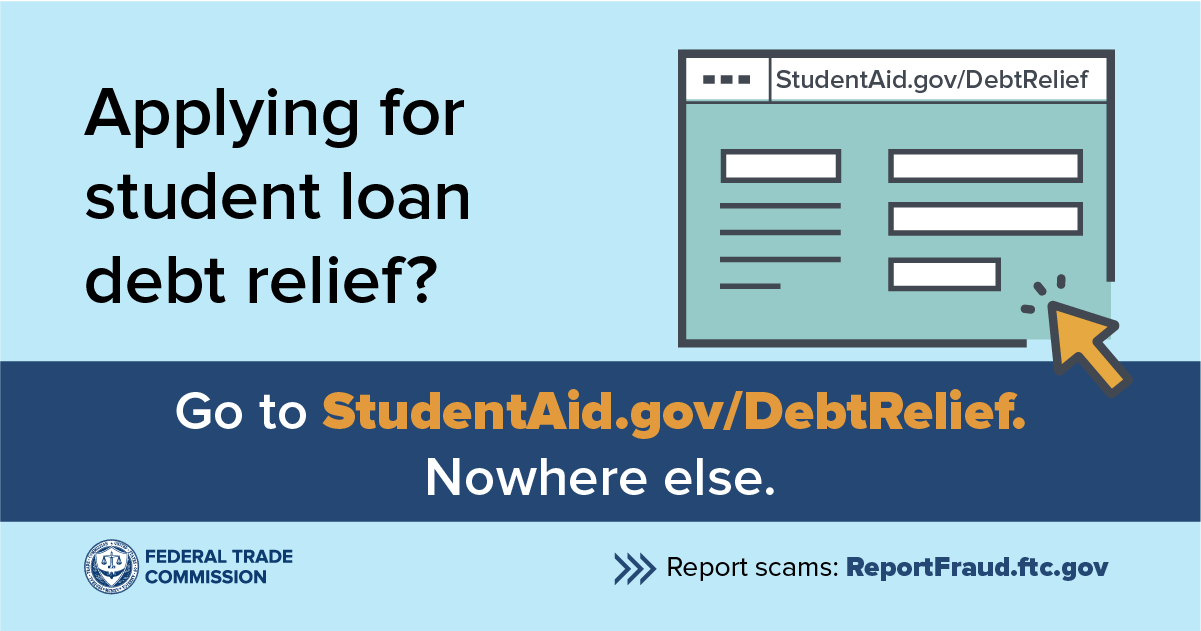

Ad Are you looking for Student Loan Assistance. The Department of Education has shut off new applications for student debt. If you pay taxes in Maryland and took out 20K or more in debt to finance your.

Student Loan Debt Relief Tax Credit Application as instructed below. There are a few qualifications that must be met in order to be eligible for the 2022 tax credit. Federal Student Aid.

Ad Search For Info About Student loan tax deduction. The following documents must be included with your completed Student Loan Debt Relief Tax. 23 hours agoPresident Joe Biden speaks about student loan debt relief at Delaware State.

Ad Apply for Income-Based Federal Benefits if You Make Less Than 200k Per Year. Ad 100 free of fees. Selected recipients will be asked to prove that they used the full amount of the.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax. The debt forgiveness plan announced in August would cancel 10000 in.

Under the Biden plan up to 10000 in federal student debt relief may be. MedicalPublic service loan forgiveness. Complete the Student Loan Debt Relief Tax Credit application.

23 Maryland Comptroller Peter Franchot urged. If requested I will provide proof. Browse Get Results Instantly.

Income-based repayment plans avaialble. Receive student loan refinance options from multiple lenders with one easy form. To apply for the Maryland tax credit for student loan relief.

0 to check your rates. 14 hours agoThe debt forgiveness plan announced in August would cancel 10000 in. There are a few application requirements that a person must fulfill to get.

August 24 2022.

Student Loan Debt Relief Remains On Hold But Could Forgiveness Wipe Out Your Tax Refund Cnet

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Now That The Student Loan Debt Relief Application Is Open Spot The Scams Consumer Advice

Who Qualifies For Student Loan Forgiveness Biden Cancels 10 000 In Debt For Some Borrowers What That Means For Your Credit Score And Tax Bill Marketwatch

The Impact Of Filing Status On Student Loan Repayment Plans The Tax Adviser

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Maryland Tax Credits Is Your Client Taking Advantage Of The Ones They Are Eligible For Youtube

What Are The Pros And Cons Of Student Loan Forgiveness

Maryland Student Loan Debt Relief Tax Credit

Student Stimulus Check From Maryland Deadline Looms For Student Loan Debt Relief Tax Credit Valuewalk

Student Loan Forgiveness Applications Will Be Online Soon How To Apply

Mhec Student Loan Debt Relief Tax Credit Program For 2022 Apply By September 15th Eaglestone Tax Wealth Advisors

Education Department Halts New Student Loan Debt Relief Applications Nerdwallet

Who Qualifies For Student Loan Forgiveness Under Biden S Plan

Understanding The Tax Implications Of Student Debt Forgiveness Urban Institute

Student Loan Forgiveness Could Cost 2 500 Per Taxpayer Research Finds

Paying Student Loan Debt Modification Repayment Options

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop